Revolutionize Your Business with Melio - The Ultimate Payment Solution

Are you tired of juggling multiple payment methods for your business? Do you want to streamline your payment process and save time and money? Look no further than Melio, the ultimate payment solution for small businesses.

Melio is a cloud-based platform that simplifies the way businesses pay and get paid. With Melio, you can pay any vendor or supplier using a bank transfer or debit card, even if they don’t accept electronic payments. You can also request payments from customers via email or text message, making it easy for them to pay you online.

Benefits of Melio.

Here are some of the benefits.

1. Save Time and Money.

Melio eliminates the need for paper checks, stamps, envelopes, and trips to the post office. You can schedule payments in advance and set up recurring payments so that you never miss a deadline. Plus, there are no transaction fees when paying vendors by bank transfer.

2. Improve Cash Flow.

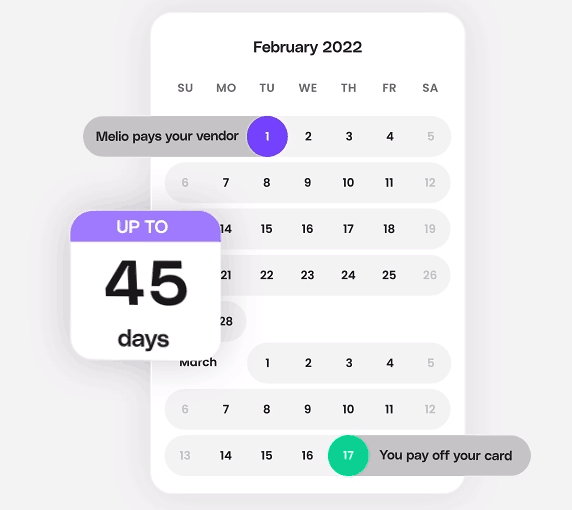

With the early payment feature, you can pay vendors early while extending your own payment terms by up to 45 days. This means that you can keep more cash on hand to invest in your business.

3. Increase Efficiency.

Melio integrates with popular accounting software like QuickBooks Online and Xero so that all your transactions are automatically recorded in one place. You can also add multiple users with different levels of access so that everyone on your team can use Melio without compromising security.

Technical Features of Melio.

Now let’s take a look at some technical features.

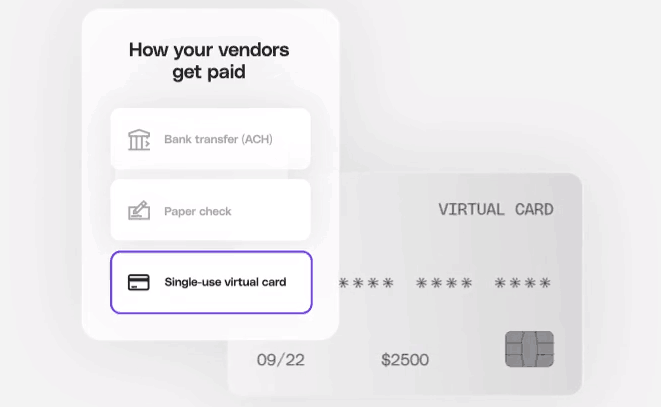

1. Bank Transfer Payments.

Melio allows businesses to make bank transfers directly from their checking account without any transaction fees.

2. Debit Card Payments.

If a vendor doesn’t accept electronic payments or requires immediate payment confirmation, businesses can use their debit card through Melio at a flat fee of 2%.

3. Payment Requests.

Melio allows businesses to request payments from customers via email or text message, making it easy for them to pay online.

4. Early Payments.

Melio’s early payment feature allows businesses to pay vendors early while extending their own payment terms by up to 45 days.

Use Cases for Melio.

Now let’s take a look at some use cases for applying Melio to business.

1. Small Business Owners.

Small business owners can use Melio to streamline their payment process and save time and money. They can schedule payments in advance, set up recurring payments, and request payments from customers via email or text message.

2. Freelancers and Contractors.

Freelancers and contractors can use Melio to get paid faster without having to wait for paper checks in the mail. They can also send payment requests directly from the platform, making it easy for clients to pay online.

3. Non-Profit Organizations.

Non-profit organizations can use Melio’s early payment feature to improve cash flow and keep more funds on hand for their programs and services.

Conclusion.

In conclusion, if you’re looking for a simple yet powerful payment solution that will revolutionize your business, look no further than Melio. With its advanced features like bank transfer payments, debit card payments, payment requests, and early payments – all at no transaction fees – you’ll be able to streamline your processes while saving time and money. Sign up today!